TurboTax 2023 Online Tax Preparation

With

TurboTax 2023 tax filing products you'll be ready for tax law modifications to come for the

April tax filing deadline.

With

TurboTax 2023 tax filing products you'll be ready for tax law modifications to come for the

April tax filing deadline.

Now that our politicians have put forward the largest tax reform legislation in decades, were all in line to see how it shakes out. Most taxpayers will feel the first effects of this on Aril 15th 2023 as the tax filing deadline comes into play. If you’re contemplating how you’ll be affected, not to worry, TurboTax works hard to make sure their tax software is up to date with fully guided support, and always programmed to get you the biggest refund.

Some of the most prominent tax law changes in this tax bill will be here for a while while others may expire or need to be renewed.

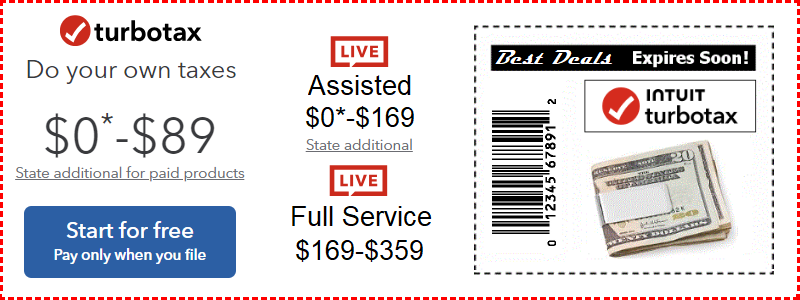

TurboTax Saves You Money On 2023 Taxes!

Every year TurboTax Software uses superior knowledge of the tax laws to ensure tax payers get every tax deduction and credit they can qualify for. Their tax programs use approved forms, check for entries that could trigger an IRS audit, double checks all your data for errors, then makes sure it's accurate and all tax deductions have been added. This is how they insure the biggest refund guarantee.

Bookkeeping and accounting financial services including accountants and CPA's in most ways are no match to the way TurboTax can review and detect problems and missed tax credits or deductions. Simply put, they are not a computer programmed with decades of tax laws and knowledge. But TurboTax Is!!!

TurboTax offers a product to fit every tax payer. Whether it be a personal, basic or standard product for home use, or something more up scaled like deluxe, premier or home and business combined programs for self employed and professional business tax planning.

These programs operate on computer systems running windows 7, 8, 10, linux, or mac, and are available online or by download with updatable software installation and cd files. Online comparison charts of TurboTax products for federal, IRS and state tax filing offer multiple choices, along with electronic submission when you file your return by efile.

TurboTax uses the current Income tax bracket and rate changes to insure accurate calculations

As it has been for several years, we still have seven tax brackets, but tax rates have been lowered and the income thresholds (brackets) at which the new rates apply have changed a bit as well.

The current tax rates are: 10%, 15%, 25%, 28%, 33%, 35% and 39.6%

The new tax rates applied in April 2023 tax filing are: 10%, 12%, 22%, 24%, 32%, 35% and 37%

The income tax brackets at which these rates kick in have changed, as well.

2023 Income Tax Brackets & Rates for April 2023 Tax Return

| Tax Rate | Individuals | Married, Filing Jointly |

|

|

|

Compare to Previous Year

| Tax Rate | Individuals | Married, Filing Jointly |

|

|

|

TurboTax 2023 offers Guidance for Individual and Family Tax Relief

The new tax laws increased the standard deduction amount that nearly doubles for single taxpayers who will find that their standard deductions jumped from $6,350 to $12,000 for their tax return to be filed in 2023. Married couples filing jointly will see an increase from $12,700 to $24,000. With these increases in place fewer taxpayers will need to itemize.

The new tax code has increased the standard deduction for tax filers, but curbed many itemized deductions. To keep up with all these changes TurboTax offers advice on 2023 tax filing to help steer tax payers in the right direction. These changes will include a $10,000 cap on the amount of state and local taxes you can claim for deductions, and the outright elimination of miscellaneous itemized deductions such as un-reimbursed employee expenses and investment fees.

Now that fewer people will be itemizing, it's important to look for tax efficient ways that you can pay for things. For instance you can use your health savings account to pay for long-term health care insurance premiums if there is enough to handle the expense. TurboTax 2023 Software will be ready to ensure you're taking advantage of tax breaks wherever you can. The TurboTax step by step support looks for additional deductions that may apply to your tax filing status as you proceed through the tax preparation process.

Tax Tips: TurboTax 2023 Tax Reform Center

As the new tax laws come into play in 2023, the TurboTax Tax Reform Center offers full spectrum advice for taxpayers looking for support on the impact these new tax laws will have now, and how they will be felt for years to come. With that in mind, there are specific parts of the act that will have big effects on individual taxpayers this coming tax season that may be something to be concerned about.

Fortunately, the ever popular TurboTax 2023 Online Tax Preparation process, as always, will play a big roll in keeping your fees down and ensuring you will get all the tax benefits, credits and deductions possible.

Home Ownership Tax Law Changes for 2023

Homeowners will see changes in the new tax law that are very important to know. Existing homeowners may find fewer tax deductions to lower tax liability, especially in states with high property taxes since the new laws limit the amount of state and local property taxes that can be deducted to $10,000. The bill also caps the amount of mortgage debt on new home purchases for which interest can be deducted at $750,000, down from $1,000,000 previously.

2023 brings an Increase in the Child Tax Credit:

The Child Tax Credit has been doubled from $1,000 per child to $2,000 for families with children. Additionally, the refundable amount increased from $1,100 to $1,400. An additional non-refundable credit of $500 for dependents other than children has also been put in place. Additionally, the income threshold at which these benefits phase out has been raised from $110,000 for married couples to $400,000. Personal and dependent exemptions are expected to increase to $4,150.

Health Care Insurance Changes for 2023

The Health Care tax penalty for not having health insurance after December 31st has been eliminated. Plus the floor above which out-of-pocket medical expenses can be deducted has been lowered from 10% to 7.5%. You can now deduct medical expense costs that are more than 7.5% of your adjusted gross income.

All in all, TurboTax is here to help tax payers get the best result on their tax return filing.