TurboTax 2024 Tax Software and Apps

We

are all waiting for the TurboTax 2024 tax preparation software’s release

date from Intuit so we can get a head start on our 2021 taxes early before the April 2024 tax filing deadline! I know it’s hard to think about

doing

taxes right now but software development works diligently ahead of release dates to update

software based on tax law changes.

We

are all waiting for the TurboTax 2024 tax preparation software’s release

date from Intuit so we can get a head start on our 2021 taxes early before the April 2024 tax filing deadline! I know it’s hard to think about

doing

taxes right now but software development works diligently ahead of release dates to update

software based on tax law changes.

TurboTax is consistently released around mid November and we fully expect that it will be similar this year as to how it was in previous years. Here we will cover information we find consistent in previous year releases, software updates, and options for online tax return preparation.

When Is The TurboTax 2024 Tax Year Software Release Date?

Intuit's release of TurboTax new tax year software in previous years should fairly closely project the TurboTax 2019 tax year release date. This is the software line you will use to prepare your tax return for the April 2024 tax filing deadline.

The previous year releases tended to be around mid November. TurboTax 2024 will announce their release date for the upcoming 2021-2024 tax season which begins mid November 2021, a common timeframe based on previous year tax software release dates.

- TurboTax 2021 release date: To Be Determined November 2021

- TurboTax 2020 previous release date, December 03, 2020

- TurboTax 2019 previous release date, November 05, 2019

- TurboTax 2018 previous release date: November 12, 2018

- TurboTax 2017 previous release date: November 14, 2017

- TurboTax 2016 previous release date: November 11, 2016

- TurboTax 2015 previous release date: November 10, 2015

How To Use TurboTax 2024 For Free

Of course with TurboTax 2024 the TurboTax “simple tax returns only” Free Edition does allow qualifying tax payers to prepare and file their tax return for free. However it should be noted that this edition of TurboTax is limited in its abilities to work for simple tax returns that do not require extra guidance for investments and typical family friendly tax filing as compared to other versions but if you start with the TurboTax free edition for simple tax returns only "not all taxpayers qualify" they will prompt you to upgrade if it finds that another edition will work better for your tax filing needs.

TurboTax allows you to import previous year data to simplify the process for a new tax year, however this feature has been limited on the free edition in the past so we will see if TurboTax loosens the reigns on this for this edition in the new release.

When you make the effort to sign up and use the TurboTax software you will be asked if in your previous year you used a CPA, went to a tax service such as H&R Block, whether you used a different software brand, or if it’s your first time doing taxes.

To start the tax preparation process you will need to create an account if you haven't already got one. To create a TurboTax account you will need your email address, your phone number, and to choose a user ID and password.

Limitations in the TurboTax 2024 Free Edition

Even though the free version of TurboTax for simple tax returns only "not all taxpayers qualify" for 2024 is nice, the limitations may require an upgrade to the deluxe edition. TurboTax does not offer a free version as a CD or download, it is only available as an online tax preparation edition. You can only access the free edition online through the Intuit website.

Here are a few features that you will get with the free TurboTax “simple tax returns only” Free Edition:

- You can file 1040EZ, 1040A, Schedule B, or Schedule EIC tax returns and this option will only work if you don’t have a complicated tax

return.

- 1040A: United Stated individual income tax return

- 1040EZ: Income tax return for single or joint filers without dependents

- Schedule B: This is your interest or dividend income

- Schedule EIC: If you have any earned income credit it will be filed here.

- You can electronically file your tax return through TurboTax.

- You can import your W-2 tax form information.

- You can upgrade to Deluxe, Premier, or Home and Business anytime if needed

TurboTax 2024 also allows you to take a photo of your W2 and automatically import this information from the photo to your tax form to avoid having to enter in all your tax information manually.

TurboTax 2024 Tax Apps for Tax Preparation Support

TurboTax 2024 Tax Return App

The TurboTax tax return app allows users to snap a photo of their W-2 to import the tax data, answer simple questions about their life, then e-file securely from their mobile device or computer to file their tax return with the IRS.

This process with the TurboTax Tax Return App works interconnected in a secure way that allows users to switch between their iPhone, iPad and computer as desired. No tax knowledge is needed as TurboTax guides you through the whole process. The TurboTax app will ask simple questions and coach taxpayers through the process one step at a time. The tax program will automatically double-check your answers and results as you go, to make sure your taxes are done right, and compliant to the new 2024 tax law reform bill congress has put in place.

TurboTax Tax Return App Features

- TurboTax Live can connect you to a CPA or EA on screen for live tax advice whenever needed. Get answers from tax experts on demand and a one-on-one review before you file if desired.

- Discover Industry Specific Tax Deductions take advantage of every deduction you can qualify for with TurboTax Self-Employed.

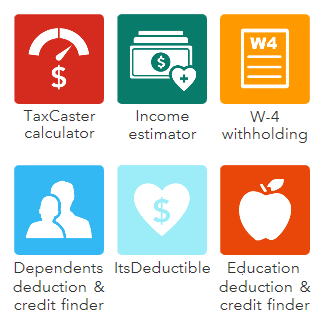

- Easy Navigation and access to other apps like the financial health app, Mint, TaxCaster and ItsDeductible.

- SmartLook™ Live on-screen video help connects with a live TurboTax specialist that can guide you by drawing on your screen.

- Step-by-step guidance leads tax filers through the tax preparation process.

- W-2 import provides the ability to snap a photo of your W-2, verify data, and automatically import information into your tax forms.

- Facial ID, Touch ID and PIN - provide secure access on any device, for the ability to switch between your phone, tablet and computer.

- ExplainWhy™ Tax App explains your tax refund to you

- TurboTax Live available for any tax situation through the full TurboTax product line: Free Edition, Deluxe, Premier, Self-Employed.

- Searches through 350+ tax deductions and credits to help taxpayers maximize their tax refund. Deluxe, Premier, Self-Employed and TurboTax Live

- Direct Deposit for quick tax refund receipt.

- Start Free, pay only when you file your tax return* or pay with your tax refund.

TurboTax TaxCaster App

Calculate

your taxes on the fly all year round to stay on top of your income tax liability. Job

changes, pay raise, bought a new house??? All these types of changes have an effect on your

income taxes, stay on top of it year round by entering changes as they happen.

Calculate

your taxes on the fly all year round to stay on top of your income tax liability. Job

changes, pay raise, bought a new house??? All these types of changes have an effect on your

income taxes, stay on top of it year round by entering changes as they happen.

This is easily my most favorite app. It's the best for simple fast track updating. I can make adjustments to income when I have side jobs and track my expenses as well by adding it to the app as I spend.

Did you get married, or have a baby? you can add that too as your life changes.

TurboTax Scores - Income & Credit App

TurboTax Scores Income and Credit manages your financial health and allows you to get your free credit score from TurboTax

TurboTax ItsDeductible charity donation tracker

The TurboTax ItsDeductible app is the best on the move charity and donation tracker to help you take advantage of charitable giving. Track donations year-round, add donated items, track mileage, record cash donations, and accurately value your donated item. All in one tracker.

TurboTax Business Extensions App.

The TurboTax business extension app allows taxpayers to securely file a business tax extension for corporations, partnerships, estates and trusts from your phone. Look up public information to enter it as needed.

One of the best features of TurboTax is their refund finder and benefit assist. Their refund finder checks hundreds of additional tax deductions that can allow you to owe less in taxes or perhaps get a bigger refund back. With the new benefit assist the software will determine if you qualify for food stamps, Medicaid, or even if you can get discounted gas or electricity. This is a great opportunity to save money and really the key reason why you would use TurboTax over other options. They are the best, apart from hired professional CPAs, at getting the maximum refund in my opinion. All of this, with the ability to save lots of money by not paying for a CPA or another person to do your taxes.

In 2024 income tax planning will be much easier with the new TurboTax tax apps and tools with top rated features that make financial management a breeze. If you liked this post please also share it on Facebook and Twitter so your friends can read about the new upcoming TurboTax 2024 Apps and Tools!