2023 - 2024 TurboTax Quick Start Guide

Whether

you're a first time tax filer, or using TurboTax for the first time, we

are here to get you up and running in a jiffy!

Whether

you're a first time tax filer, or using TurboTax for the first time, we

are here to get you up and running in a jiffy!

In this introduction to TurboTax 2023 - 2024 tax season software, several factors are addressed right off the get go to get you pointed in the right direction:

- Do you prefer to download desktop installation software, or use TurboTax online tax preparation?

- Which TurboTax edition will work best for your tax filing needs?

- How flexible is TurboTax if it becomes advantageous to upgrade or downgrade to another edition?

- Updating your Download / CD Version as needed to insure accuracy!

Choose Between TurboTax Online, or Download / CD

First I would like to point out that TurboTax Online Tax Preparation versions are by far more popular than desktop software versions. This is a common trend through all brands in the industry. Many factors come into play when making your decision on which format to use.

|

Compare 2017 Season-to-date TurboTax Federal Unit Data |

|

|

2017 Version Unit Sales |

Season through April 21, 2017 |

| TurboTax Online | 29,814,000 |

| TurboTax Desktop | 5,030,000 |

| TurboTax “simple tax returns only” Free File Alliance | 1,169,000 |

| Total TurboTax Units | 36,013,000 |

The TurboTax Online Versions are quick and easy to use over a secure connection to the TurboTax website. There is no software to install and you can work on your tax return from any computer with an internet connection. Start your return at work and finish it at home, all progress is saved so that you can continue right from where you left off.

The TurboTax Download / CD Desktop Installation Tax Software Versions allow tax payers to work on their tax return without the need for an internet connection. This is great for those in remote locations, however these versions require you to install the software on your computer which may lead to conflicts with other preinstalled software. It's a rarity, but it can happen. Be sure to Update TurboTax Desktop Versions as needed.

For simplicity purposes, my advice is to go with Online Tax Preparation if at all possible!

Choose The Correct Edition For Your Tax Filing Needs

Determine which edition suites your tax filing needs the best:

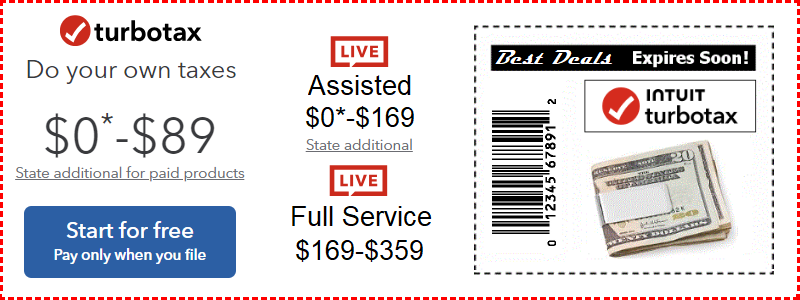

- TurboTax “simple tax returns only” Free Edition: TurboTax Free Edition for simple tax returns only "not all taxpayers qualify" (online and mobile only) plus Absolute Zero $0 programs work for federal (forms 1040EZ/1040A) and may include + $0 state limited time offers at times. The free edition works for simple tax returns without the need for extra guidance.

- TurboTax Basic Edition: is a download / cd desktop tax software version only. It is a good choice if you do not itemize deductions, you file the federal 1040EZ or 1040A form. Saves time by importing financial data including W-2s, mortgage data, and financial information, plus guidance with health care laws.

- TurboTax Deluxe Edition: includes support for itemized deductions related to mortgages, charitable contributions or other expenses you can write off. It searches through 350+ tax deductions, credits, and maximizes real estate tax deductions. Plus take advantage of charitable donations and contributions.

- TurboTax Premier Edition: imports investment income and cost basis to cover stocks, bonds, ESPPs and other investment income (Schedule D). Report rental property income, expenses, and tax deductions (Schedule E).

- TurboTax Home + Business Editions: Prepare your personal and business tax returns with support for self-employment and small business income and expense reporting (Schedule C). Maximize your business tax deductions and asset depreciation.

- TurboTax Business Edition: Partnerships, S Corp, C Corp, multi-member LLC, trusts and estates.

How To Upgrade To Another TurboTax Online Edition

You can upgrade or switch to a higher version of TurboTax after you've started your return if you find another edition will suit you better. Select Upgrade in the menu interface on the left, or the menu icon in the upper-left corner. Then, select the version you'd like to upgrade to. Sign out and then sign back in to access your prior-year return or other upgrade features.

How To Downgrade to a Lower TurboTax Online Edition

You can downgrade to a lower online edition but each edition of TurboTax is designed to handle different tax situations and their associated forms. While you’re welcome to downgrade, you may miss some features—and you’ll be prompted to upgrade when those features are needed.

To downgrade you must clear and start over in TurboTax Online. To do this erase your return and start from scratch as long as you haven't submitted payment, deducted the TurboTax fee from your refund, or registered.

If you haven't already done so, sign in at TurboTax.Com and select the Take me to my return button. On the welcome back screen, in the left-side menu, select Tax Tools, and then Clear & Start Over (select the menu icon in the upper-left corner if you don't see this menu).

TurboTax 2023 - 2024 Income Tax Filing

Jumping Into The Tax Return Preparation Process

If you are using a desktop version, start by checking for updates to insure the most up to date tax law modifications are in place. Online versions are automatically updated as they happen so no update process is needed.

Another up front process I like to perform is estimating my tax liability ahead of time so that I'm more prepared for what Uncle Sam may be expecting from me. It's a good thing to do this several times a year as changes in your life and finances happen so that you're always in tune with your financial tax liability.

Next gather up all the documentation needed for preparing your tax return. A tax preparation checklist will be handy for this purpose and insures you won't be running around in circles trying to figure out what you need.

TurboTax: Simple, Fast, Convenient!

Now you can use your TurboTax 2023 edition of choice to prepare your Federal and State Income taxes, double check them, and file them in just one night, or spend a few minutes here or there until you complete your return. TurboTax Guides you step by step once it completes an interview process designed to learn about your life and tax filing needs. This process uses the information gathered to see how it can benefit you by applying tax deductions and credits that you qualify for in order to lower your overall tax bill. Here's some more tidbits you should know about TurboTax 2023 - 2024 tax season products:

- TurboTax is the #1 rated and #1 selling product for your tax return preparation

- All your info and progress is safely saved for you so you can complete your returns at your pace anytime it's right for you

- The built-in guides and tips will help you breeze through the project while finding deductions at the same time

- Regardless of your tax knowledge, TurboTax tax support guides, tips and tools simplify tasks as they walk you through your tax return preparation in an easy to understand plain English procedure.

With TurboTax you can work on your taxes day and night, whenever the time is right for you. Get an early start to insure your not going to get stressed about meeting the April 15 2024 tax filing deadline. A small investment of your time viewing the credits and deductions tips will dramatically increase your ability to get a bigger refund, and widen your knowledge and ability to properly prepare for bigger refunds on future returns.

Compare TurboTax against H&R Block, TaxBrain, TaxAct, Tax$imple, or eSmart-Tax to see why TurboTax is rated #1.

TurboTax Canada

TurboTax Canadian Editions are the top rated choice for tax filers in Canada.

Formally known as TurboTax Canada, these tax software programs have been leading the tax software revolution in the Canadian territories for decades.

These editions come in French and English versions to accommodated filers from both languages.

Check out our blog for more talk on TurboTax products.